Monday, July 16, 2007

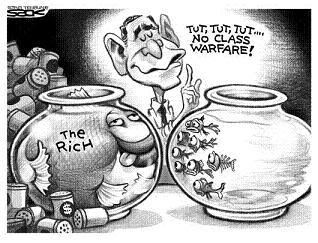

Class Warfare

When conservatives mention how much they love the 50's, they are referring likely to a time when blacks "knew their place" not to our tax structure. There have been two periods this past century when taxes were skewed towards the wealthy. Both times, the rich have gotten richer. The first was right before the depression, and the second is the current period since the experiment of Reaganomics.

When conservatives mention how much they love the 50's, they are referring likely to a time when blacks "knew their place" not to our tax structure. There have been two periods this past century when taxes were skewed towards the wealthy. Both times, the rich have gotten richer. The first was right before the depression, and the second is the current period since the experiment of Reaganomics.

Throughout the golden age of Ike in the 1950's the top tax rate was $400,000. Any income earned after that point would be taxed at 91%, with the caveat that your total tax bill couldn't be (get this) more than 87% of your income. Using an inflation calculator, it works out that the top rate at the time would be just shy of $3,000,000 in today's dollars. So if you earned $4,000,000 you would get back 90,000 of it after you hit the triggering amount on that last $1,000,000 in today's terms.

Ronald Reagan changed all that. He flattened out the tax structure so that by the time he left office the top tax was 28%, but you needed to earn just $29,750 to hit the top rate. That $29,750 is $50,896 in today's dollars. This has produced a squeeze on the middle class and our economy reflects it. It is why the progressive income tax makes so much sense and was an engine for our growth.

Combine the FICA, Social Security, Workman's comp, sales tax that hit workers in the middle class and poor harder, and mix that in with the bankruptcy bill and the difficulty in receiving affordable health coverage and this also kills entrepeneurship as well.

Our economy is geared for the wealthy to keep their money, and there are many more roadblocks in place for a person with a dream of starting their own business. Most Americans really aren't aware of how different taxation used to be in this country.

It's been a generation since Reagan's "reform". Are you satisfied with the results?

Posted by

trifecta

at

7:10 PM

![]()

Labels: reaganomics, taxation

|